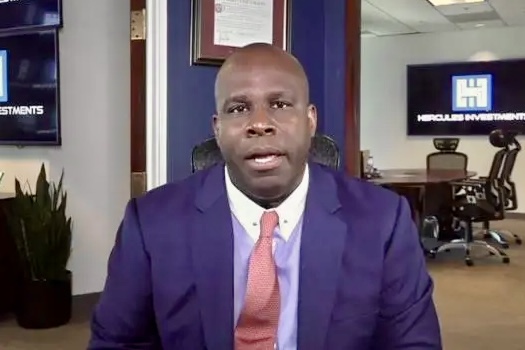

James Arthur McDonald Jr., former financial analyst at CNBC, was arrested by the FBI in Port Orchard, Washington, last Saturday (15) after being accused of defrauding millions from his investors.

+The dance floor from the movie ‘Saturday Night Fever’ has been sold for $325,000 at auction

+Nicola Coughlan and Luke Newton break a sofa during filming of a daring scene in ‘Bridgerton’

According to the U.S. Department of Justice, the former CEO of investment firms Hercules Investments LLC and Index Strategy Advisors Inc., based in Los Angeles, will be extradited back to California to stand trial “in the coming weeks”.

McDonald had been a fugitive for nearly three years, having failed to appear before the U.S. Securities and Exchange Commission in November 2021 to testify about allegations of investor fraud.

In early 2020, the former financial consultant allegedly lost “tens of millions of dollars of Hercules clients’ money after taking a risky position that effectively bet against the U.S. economy’s health following the U.S. presidential election”.

McDonald predicted that the pandemic and elections would result in major sell-offs that would cause the stock market to drop. However, when the market downturn did not materialize, Hercules lost “between $30 and $40 million” in client funds, according to the Department of Justice.

In early 2021, McDonald solicited millions of dollars from investors to raise capital for Hercules. In addition to omitting “the huge losses that Hercules had suffered previously”, he allegedly “misrepresented how the funds would be used”.

McDonald is also suspected of obtaining $675,000 in investment funds from a group of victims, which he used to spend on himself. He reportedly spent “about $174,610 of them at a Porsche dealership”.

He appeared in court last Monday (17) in Tacoma, Washington, and is expected to be transferred to Los Angeles in the coming weeks. If convicted, McDonald could face up to 20 years in federal prison for each securities fraud and electronic fraud charge, as well as 10 years for each charge related to the misuse of investor funds and five years for investment advisor fraud.

This content was created with the help of AI